Can Variance Be Negative

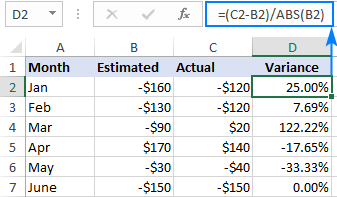

Well the problem is that when your benchmark value is a negative number the math inverts the results causing numbers to look wacky. Variance analysis is usually.

Can Variance Be Negative Statology

Variance treats all numbers in a set the same regardless of whether they are positive or negative which allows you to account for the most minute variability in data sets.

. Variance analysis first used in ancient Egypt in budgeting or management accounting in general is a tool of budgetary control by evaluation of performance by means of variances between budgeted amount planned amount or standard amount and the actual amount incurredsold. Variance or Coefficient of Variance. Portfolio variance is a statistical value that assesses the degree of dispersion of the returns of a portfolio.

The sample variance of this dataset turns out to be 248667. We use variance when we want to quantify how spread out values are in a dataset. The variance of the second dataset is much larger than the first which indicates that the values in the second dataset are much more spread out compared to the values in the first dataset.

Negative ulnar variance describes a state where the ulna is abnormally shortened by more than 25mm compared to the radius and plays an important role in wrist pathology. This is a real problem in the corporate world where budgets can often be negative values. This version DOES have macros.

A negative percentage will show negative variance and a positive percentage will represent the positive variance. So yeah guys this how you can use create reports on actual vas forecasted data. A variance in management accounting may be favorable costs lower than expected or revenues higher than expected or adverse costs higher than anticipated or revenues lower than expected.

I have conditionally formatted this column to highlight negative values with red text. There are four variations of the cost variance formula used in earned value management EVM. The second formula is the negative convention which measures negative variances as a negative value and positive variances as a positive figure.

To see a different type of Budget Variance workbook download the Budget Report Selector-- Enter Forecast and Actual data for a budget see the summary in a pivot table. This will ease the analysis and help in decision making. This implies that the variance shows how far each individual data point is from the average as well as from each other.

It is an important concept in modern investment theory. Maximum forearm pronation results in an increase in positive. A sample is a set of observations that are pulled from a population and can completely represent it.

For example expenses may have come in higher than planned but that produces a negative variance to profit. Although the statistical measure by itself may not provide significant insights we can calculate the standard deviation of the portfolio using portfolio variance. The sample variance is measured with respect to the mean of the data set.

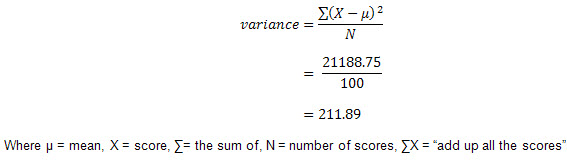

In probability theory and statistics variance is the expectation of the squared deviation of a random variable from its population mean or sample meanVariance is a measure of dispersion meaning it is a measure of how far a set of numbers is spread out from their average valueVariance has a central role in statistics where some ideas that use it include descriptive. When explaining budget to actual variances it is a best practice to not to use the terms higher or lower when describing a particular line time. If a variance is extremely high negative changes need to be made.

It plays important role in wrist pathology such as ulnar impaction syndromes and thinning of the triangular fibrocartilage complex. This usually happens. We could use this same methodology to tell our readers if the change was positive P or negative N when either value is negative.

Advantages of Variance Variance helps you to gain helpful information about a data set for better decision-making. There is a significant association between negative ulnar variance and Kienböck disease although the majority of people with negative ulnar variance do not have this condition. The Wall Street Journal guide says that its earning reports display a P or L if there is a negative number and the company posted a profit or loss.

Intuitively we can think of the variance as a numerical value that is used to evaluate the variability of data about the mean. If there is an extremely low cost variance positive or zero variance they can take it as a sign of effective cost management. If we have a negative covariance it means that both variables are moving in opposite.

Budgeted Spending Actual Spending Variance Theres no right way here. Unfavorable budget variances refer to the negative difference between actual revenues and what was budgeted. Advantages of Coefficient of Variation Over Variance.

Click the Slicer to change values in the Pivot Table report - choose the forecast actual YTD Variance or Variance Percent. A key to the VAC value as a project management tool is in knowing the formula can result in positive values negative values or even a value of zero. By default BugBase will analyze and plot your data using a threshold that has the highest variance across all samples.

Either positive variance or negative variance reflects negatively on the budgeting efficiency unless caused by extreme events. Positive ulnar variance describes where the distal articular surface of the ulna is more than 25mm distal to the articular surface of the radius. Variance at Completion VAC Interpretation.

Financial managers can analyze the data to consider if a favorable budget variance is a result of higher than planned selling prices greater quantities lower expenses or an unexpected increase in customer demand. For VAC calculations not only is the numerical value of importance but the positive or negative status of that value is as well. The Four Types of Cost Variance Formulas in EVM.

Show Positive or Negative Change. Oving to a new home in childhood can impede school performance social skills and behavior a new study finds and the negative effects accumulate such that children who move multiple times are at greater risk1 Moving has different effects at different ages and changing schools adds to the stress. It is also known as the estimated variance.

Negative Binomial Distribution Practice Problems. The variance in the number of failures we expect before achieving 4 successes would be pr 1-p 2 54 1-5 2 8. Variance analysis can be carried out for both costs and revenues.

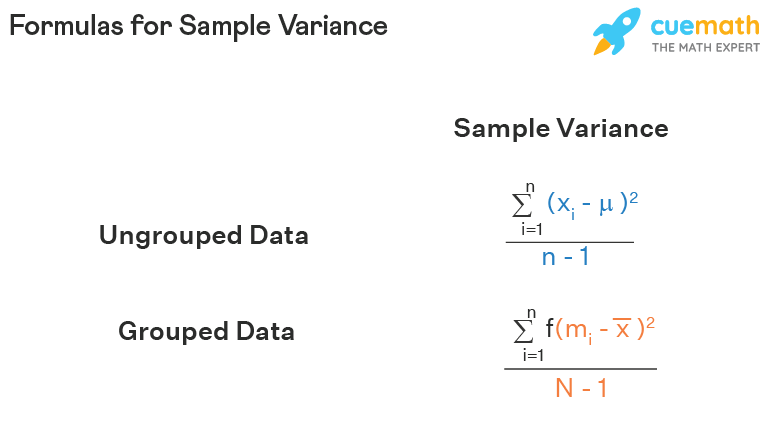

If you choose to use the coefficient of variance which is the ratio of the standard deviation to the mean you can select the Use Coefficient of Variance option instead. As data can be of two types grouped and ungrouped hence there are two formulas that are available to calculate the sample. Either convention is acceptable provided its consistently applied across all your analyses.

Use the following practice problems to test your knowledge of the negative binomial distribution. Actuals came in worse than the measure it is compared to. How can you say that your percent variance is 220 when you clearly made money.

Sample Variance Definition Meaning Formula Examples

Can Variance Be Negative Statology

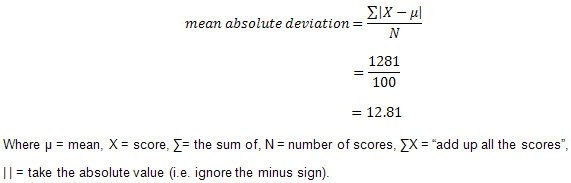

Absolute Deviation Variance How And When To Use These Measures Of Spread Laerd Statistics

Can Variance Be Negative Statology

Absolute Deviation Variance How And When To Use These Measures Of Spread Laerd Statistics

How To Calculate Percent Change In Excel

0 Response to "Can Variance Be Negative"

Post a Comment